On a recent diligence call with an entrepreneur whose startup we were interested in funding, I was asked why they should take our money over some of the other firms competing to let them invest. The question was insightful and made me like the entrepreneur and his thoughtful approach even more.

As a thematic fund focused on voice tech, VoicePunch sits in a somewhat unique and occasionally lonely place for a fund, as there are not a lot of folks like us. In fact, outside of the corporate investment vehicles like Amazon’s Alexa Fund and similar platform investors, you can count the number of thematic voice tech funds on one hand. During the first few months after launching in early 2019, this meant that at least once a day I was asked the question – “Hey, do you think you are early?”

Invariably the autopilot reply to this interrogatory became, “Yes, we may be a bit early, however it’s somewhat challenging to tell. However, if we were late, it would be obvious to everyone.”

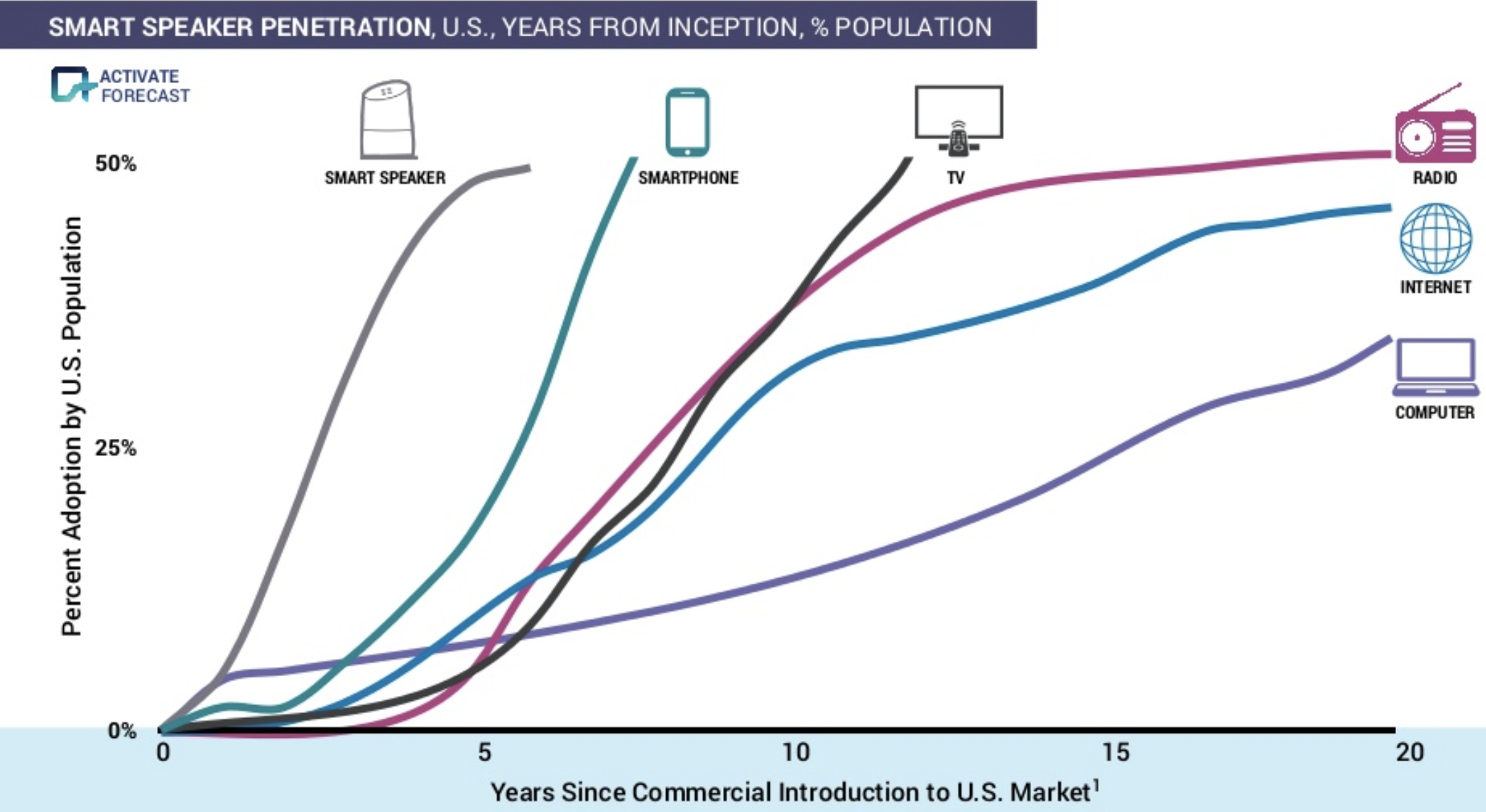

SMART SPEAKERS ARE THE FASTEST ADOPTED CONSUMER TECHNOLOGY OF ALL TIME